Acts of terrorism are heartbreaking and significantly affect individuals and families as well as businesses; recovering from these tragic events can be painstakingly difficult. For businesses, the type of insurance coverage in place prior to the tragedy plays a role in the ability to recover.

Acts of terrorism are heartbreaking and significantly affect individuals and families as well as businesses; recovering from these tragic events can be painstakingly difficult. For businesses, the type of insurance coverage in place prior to the tragedy plays a role in the ability to recover.

Once upon a time, insurance underwriters perceived terrorism as a low risk occurrence, according to the Insurance Information Institute. For that reason, insured losses resulting from acts of terrorism were typically covered by commercial policies. After the events of September 11, 2001, many U.S. citizens’ perceptions of terrorism shifted and the insurance industry evolved to adopt a more guarded view.

Signed into law by President George W. Bush in 2002, the Terrorism Risk Insurance Act (TRIA) and its continuing legislation, the Terrorism Risk Insurance Program Reauthorization Act (TRIPRA), began using government databases to create definitions, limitations, and standards regarding terrorism. In doing so, these acts now provide a guide for the insurance industry to follow when assessing risks, constructing policies, and paying claims for losses resulting from terrorism.

The statutes within TRIA and TRIPRA also rendered the government an insurer of last resort by creating a federal backstop, the Insurance Information Institute explains.In other words, in the event of a terrorist attack that causes economic devastation, the government will financially back the insurance companies so that they can pay the insureds’ claims.

As defined by TRIA, terrorism is: “an act that is dangerous to human life, property, or infrastructure and to have resulted in damage within the U.S. (or outside the U.S. in the case of a U.S.-flagged vessel, aircraft or premises of a U.S. mission). It must be committed as part of an effort to coerce U.S. civilians or to influence either policy or conduct of the U.S. Government through coercion.”

Rather than wait for the government to classify a tragic event, some insurance providers now offer stand-alone terrorism insurance policies that rely on predetermined, quantifiable definitions, according to AIG. With this option, the insured and insurer are the only two parties establishing the definition of terrorism, and each terrorism insurance policy is tailored to suit the risks and needs of each individual business. As a result, claims on insured losses are paid more expeditiously, Hiscox reports.

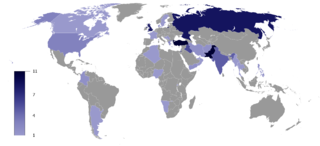

Do New Hampshire’s businesses need terrorism insurance? Is New Hampshirea high-risk area for terrorism? What defines a low-risk area? It is the job of business leaders, board members, and entrepreneurs to assess these risks and determine the best course of action.

However, it is a good idea to carefully review your commercial insurance policies to determine whether coverage for acts of terrorism is expressly excluded. Your experienced independent insurance agent can help you better understand your coverage and weigh your options. While we can never really plan ahead for terrorism, we can make certain you are adequately protected with the right commercial insurance coverage in the event of an unexpected tragedy.

At Eaton & Berube, the protection of your business is our priority. For additional insurance information and other useful resources, please subscribe to our blog or contact us.